Amazon And Whole Foods Market – What Do They Have in Common?

Amazon and Whole Foods Market both focus on customer needs and offer a place where people can find what they want. But the similarities don’t end there. Let’s take a look at these two amazing companies.

Similar Mission Statements:

Whole Foods Mission Statement: At Whole Foods® Market, “healthy” means a whole lot more. It goes beyond good for you, to also encompass the greater good. Whether you’re hungry for better, or simply food-curious, we offer a place for you to shop where value is inseparable from values.

Amazon Mission Statement: Our vision is to be earth’s most customer-centric company; to build a place where people can come to find and discover anything they might want to buy online.

Strategy:

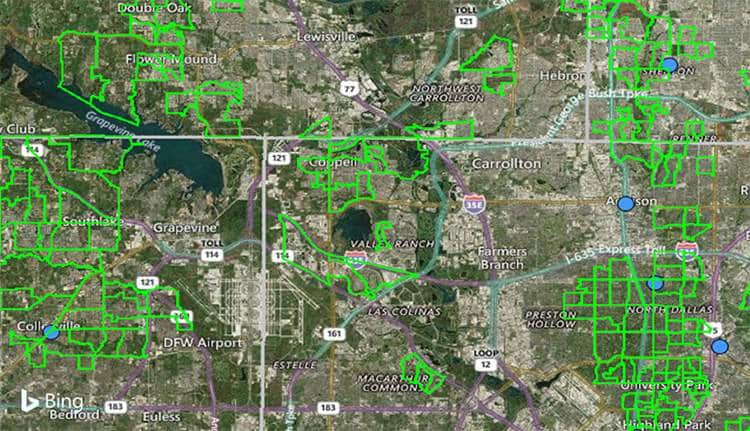

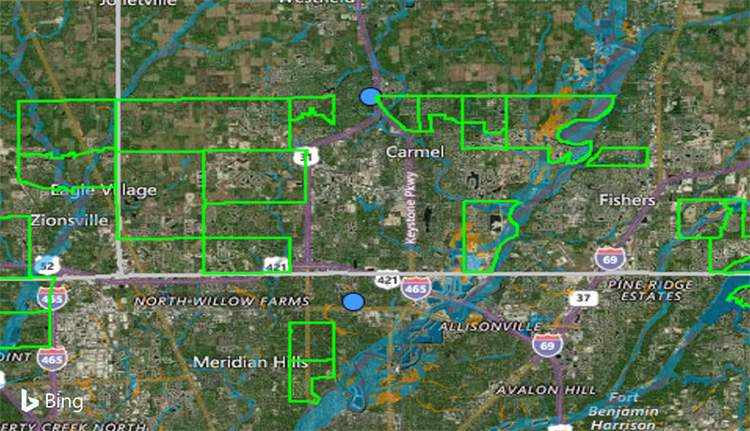

The Amazon acquisition of Whole Foods Market was an incredibly savvy market play. Whole Foods leveraged an intelligent site selection model that identified market areas that would be successful for their brand. They have over 400 store locations spread across 42 states; purple dots on the map above. Every major retailer has a proprietary site selection model built on the store’s primary value indicators. Without knowing the specific criteria for the Whole Foods site selection model, we conducted this case study with the hypothesis that median income was one of the primary indicators. Using an illustrated map, we compiled a view of a cluster of Whole Foods store locations compared to the median household income of that particular area. The map view illustrates EASI demographic household income greater than $150K as green boundaries for the Census Block group and the blue dots are the store locations for Dallas, TX.

Based on the image, it appears that the store site selection was looking for more affluent areas. To confirm our hypothesis, we ran the same search criteria for the New York and Indianapolis areas, and again the stores appeared to be centric to neighborhoods with a high median household income.

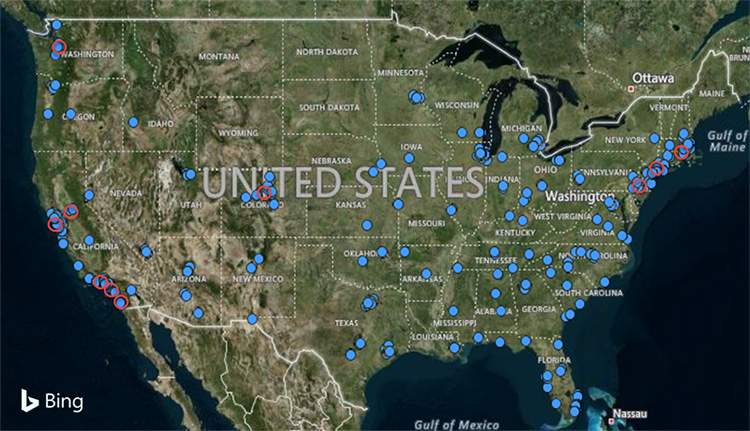

Site selection requires sophisticated market research, market planning as site selection for new stores. The proprietary model that a retailer leverages is complex and takes into consideration many more factors when determining a prime location. Store success heavily relies on the ability to use current and past data to make the best decision possible. The acquisition of Whole Foods was a strategic move for Amazon, expanding their market sized based on a model similar to theirs. Below is a map that indicates the different markets Amazon has tested their Prime Fresh subscriptions and the overlap it has with cities populated with Whole Foods.

Looking at this case study spatially, it appears that through market testing Amazon found a proprietary formula that may have been closely in line with the Whole Foods approach to site selection.

Interested in learning about our mapping solution to help you find the right market for your business? Learn more about LandVision™™ today.